fsa health care limit 2022

Employers should communicate their 2022 limit to their employees as part of the open enrollment process. Dependent Care Assistance Plans Dependent Care FSA annual maximum unless married filing separately.

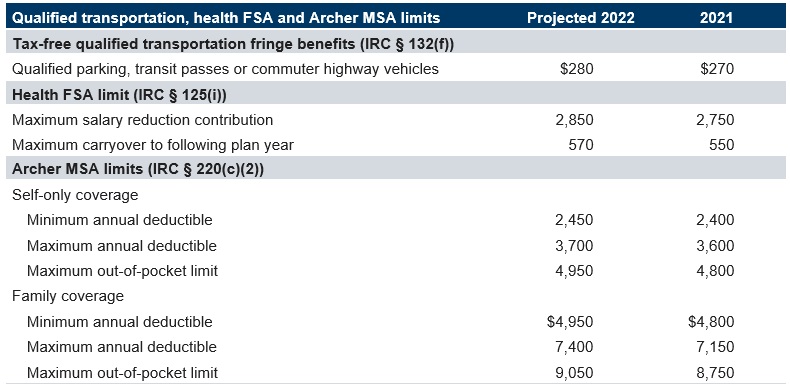

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

Dependent Care Assistance Plans Dependent Care FSA annual maximum if married filing separately.

. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. Double check your employers policies. The amount of money employees could carry over to the next calendar year was limited to 550.

The contribution limit is 2850 up from 2750 in 2021. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. Zero Guesswork When You Shop 6000 Eligible Items at FSA Store.

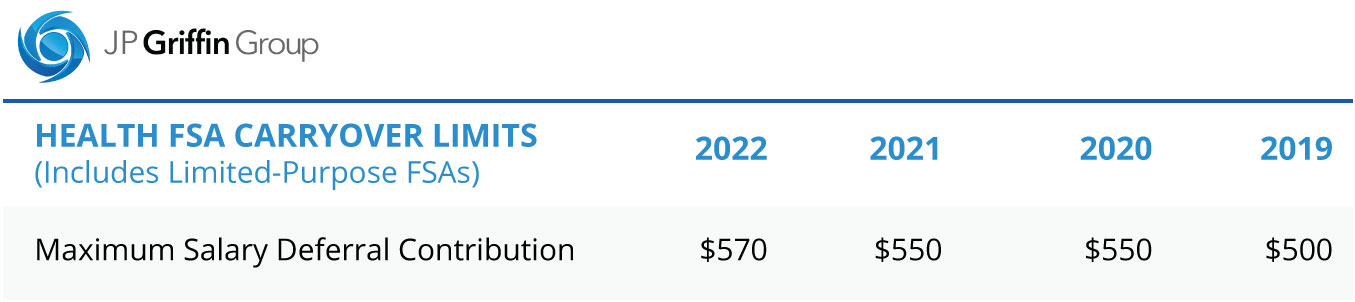

The 2022 limits for. Health FSA maximum carryover of unused amounts 570year. 2022 FSA carryover limits.

Health FSA including a Limited Purpose Health FSA 2 850 year. As with a Health Care FSA HCFSA the maximum annual allotment for a LEX HCFSA is 2850 per covered employee or 5500 for a feder. In addition you will now be able to use the remaining balance in your 2021 Dependent Care Advantage Account DCAA.

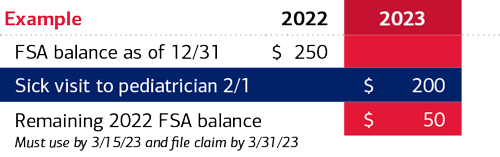

If you have the FSA Grace Period extension built into your plan and your plan year ends on December 31 you probably have a deadline coming up on March 15. Excepted Benefit HRA remains 1800year. A flexible spending account is a tax-advantaged account that allows you to use pre-tax dollars to pay for qualified medical or dependent care expenses You choose how much money you want to contribute to an FSA at the beginning of each plan year up to the plan limits and you can access these funds throughout the year There are three types of.

It is important to note that the carryover from the 2022 plan year will once again be limited to 570 or an inflation-adjusted amount. This is an increase of 100 from the 2021 contribution limits. For the 2021 income year it is 2750 26 USC.

How much can I contribute to my LEX HCFSA. You will be able to use up to 550 of monies remaining in your 2021 Health Care Spending Account HCSA towards eligible expenses incurred during the 2022 calendar year as long as you had an account as of December 31 2021. The limit on annual employee contributions toward health FSAs for 2022 is 2850 up from 2750 in 2021 with.

For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year. Employees can elect up to the IRS limit and still receive the employer contribution in addition. And the limit on total employer-plus-employee contributions to defined contribution plans will jump to 61000 in 2022 which is.

If you have adopted a 570 rollover for the health care FSA in 2022 any amount that rolls over into the 2023 plan year does not affect the maximum limit that. The pre-tax salary reduction limit for Health Care FSAs will increase to 2850 for plan years on or after January 1 2022. The limit is expected to go back to 5000.

The Health Care standard or limited FSA rollover maximum limit will increase from 550 to 570 for plan years beginning on or after January 1 2022. Effective January 1 2022 the following will be the new limits. 125i IRS Revenue Procedure 2020-45.

FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum for a combined household set aside of 5700. Health FSA Carryover Maximum. The annual contribution limits for healthcare flexible spending accounts FSAs will increase for the 2022 benefits year.

Health Care FSA Limits Increase for 2022 Employees can deposit an incremental 100 into their health care FSAs in 2022. The Health Care FSA pre-tax salary reduction limit is per employee per employer per plan year. If you have a dependent care FSA pay special attention to the limit change.

For 2022 the maximum amount that can be contributed to a dependent care account is 5000. Qualified Parking plans 280 month. For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA.

Learn more from GoodRx about the increase in FSA contribution limits and how to. Qualified Small Employer HRA QSEHRA increases to 5450year for single. The Dependent Care FSA annual maximum plan contribution limit is 2500 for those married and filing separately and 5000 for those single or married filing jointly.

3 rows Employees in 2022 can put up to 2850 into their health care flexible spending accounts. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. The 2022 medical FSA contribution limit will be 2850 which is up 100 from last year.

Healthcare Flexible Spending Account FSA 2850. If the employer contributes to the Health Care FSA the employers contribution is in addition to the amount that the. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022.

However the Act allows unlimited funds to be carried over from plan year 2021 to 2022. Dependent Care FSAs which previously allowed no carryover also have an unlimited carryover provision in 2021-2022. If you provide health care FSA employer contributions this amount is in addition to the amount that employees can elect.

Expanded FSA Grace Period. The health FSA contribution limit is established annually and adjusted for inflation. With a LEX HCFSA you can set aside anywhere from a minimum of 100 up to 2850 per benefit period plan year.

Among other things the notice indicates that employee contribution limits toward health flexible spending arrangements also known as flexible spending accounts or FSAs and qualified transportation fringe benefits will increase slightly for 2022. The IRS announced that the health FSA dollar limit will increase to 2850 for 2022. Qualified Transportation plans 280month.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021. And if an employers plan allows for carrying over unused health care FSA funds the maximum carryover amount has also risen up. Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses.

Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC. Employers may continue to impose their own dollar limit on employee salary reduction contributions to health FSAs up to the ACAs maximum. The health FSA dollar.

Ad Shop The Largest Selection Of FSA-Eligible Products Today And Get Free Shipping 50.

Best Health Insurance Companies 2022 Top Ten Reviews

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Understanding The Year End Spending Rules For Your Health Account

What S The Difference Between An Hsa And Fsa Point Of Blue

Irs Adjusts Health Fsa And Other Limits For 2022 Woodruff Sawyer

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

High Deductible Health Plan Hdhp Pros And Cons

Health Care Consumerism Hsas And Hras

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Hdhp Vs Ppo What S The Difference

New Hsa Limits For 2022 And Determine If Fsa Or Hsa Is Right For You Alltrust Insurance

Flexible Spending Account Contribution Limits For 2022 Goodrx

Flexible Spending Account Contribution Limits For 2022 Goodrx

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Irs Releases 2022 Rates For Healthcare Fsa And Commuter Benefits Sequoia

Flexible Spending Account Contribution Limits For 2022 Goodrx

Understanding The Year End Spending Rules For Your Health Account